AI VAT Invoice Information Recognition (China)

AI VAT Invoice Information Recognition (China)

v1.0.5

NagisaKon

This AI VAT Invoice Information Recognition (China) template uses Baidu AI Cloud to deliver AI invoice extraction and end‑to‑end invoice workflow automation for Chinese VAT invoices. Automatically recognize key fields, verify invoices, and write results into your database to streamline financial data management. Support supplier invoice processing and purchase order invoices in the same flow, reducing manual input, lowering error rates, and helping finance teams, SMEs, accountants, and procurement departments keep VAT invoice records accurate, searchable, and audit‑ready.

🧠 AI

📁 Operation

Included Resources

Invoice Upload Form

Automatic Invoice Recognition and Processing

Invoice Data

Workflow Graph

Workflow Graph

Workflow of AI VAT Invoice Information Recognition (China)

Release notes

Release notes

Release notes of AI VAT Invoice Information Recognition (China)

AI VAT Invoice Information Recognition (China)

This template utilizes Baidu AI Cloud's financial recognition OCR to automatically extract key information from invoices and supports invoice verification. It helps businesses or individuals reduce manual data entry and improve financial data management efficiency. It optimizes workflows, reduces human errors, and enhances data accuracy.

👉 How the Template Works

- Invoice Upload Recognition: A quick entry point for uploading invoices.

- Automatic Invoice Recognition and Processing: Uses Baidu AI Cloud's financial recognition OCR to scan invoice images and extract key content to fill in forms, supporting invoice verification.

- Invoice Data: Stores key information from invoice images and recognition results, such as invoice number, tax amount, total amount including tax, invoice type, verification results, etc.

🎯 Usage Steps

-

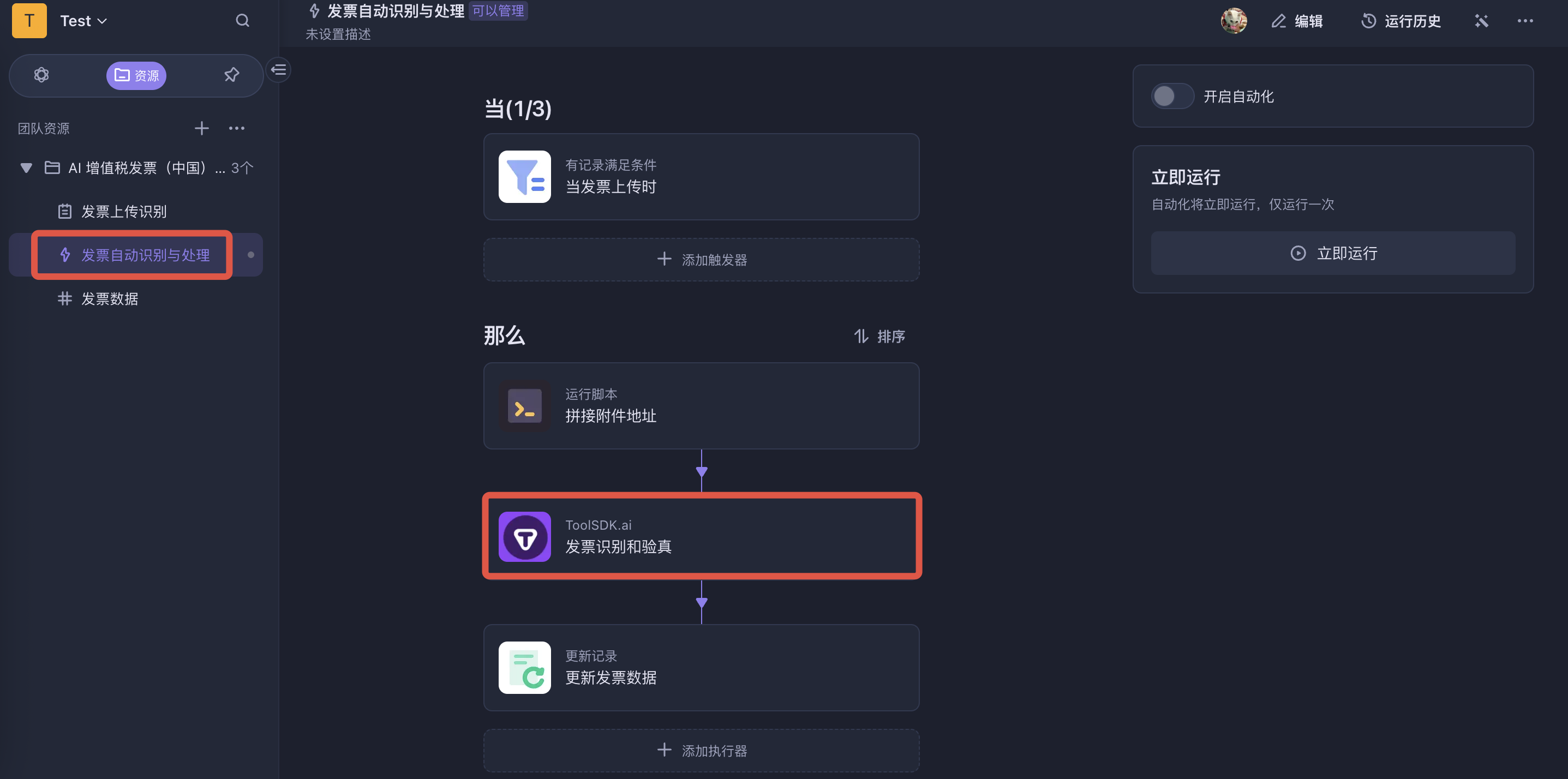

Configure and Enable Invoice Recognition Automation:

-

Register on the Baidu AI Cloud Platform and complete personal or business real-name authentication.

-

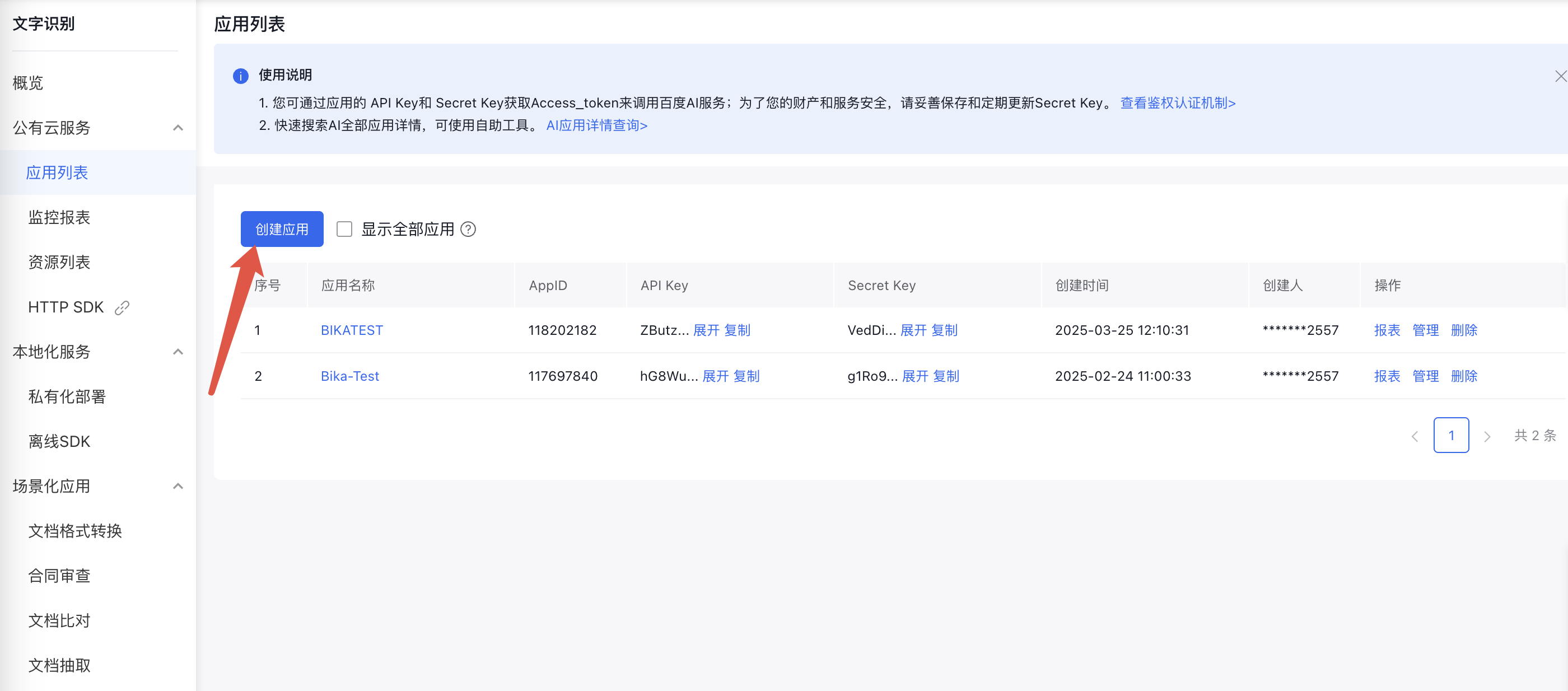

Go to the Application List to create an application.

-

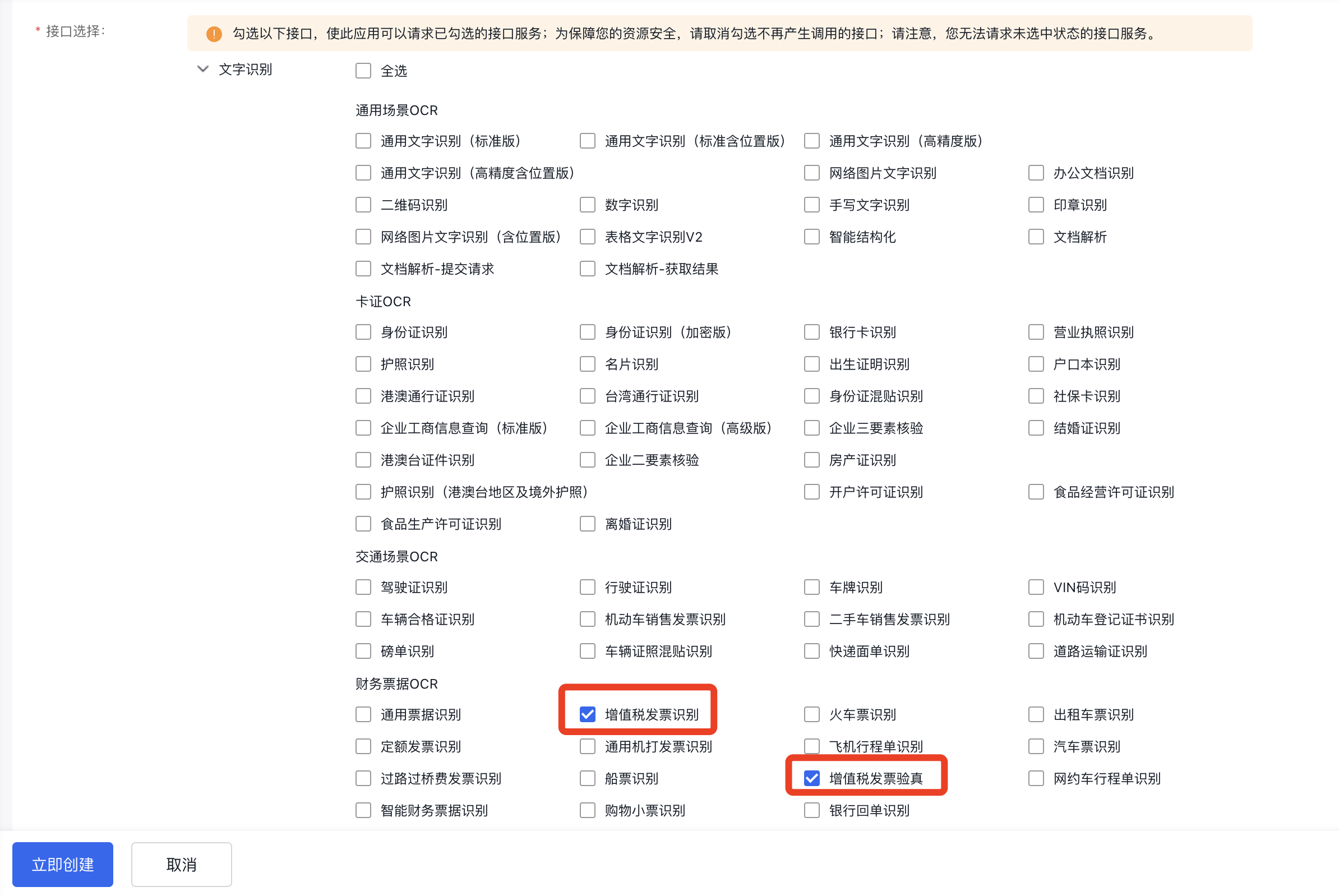

check

VAT Invoice RecognitionandVAT Invoice Verification, and obtain yourAPI KeyandSecret Key.

-

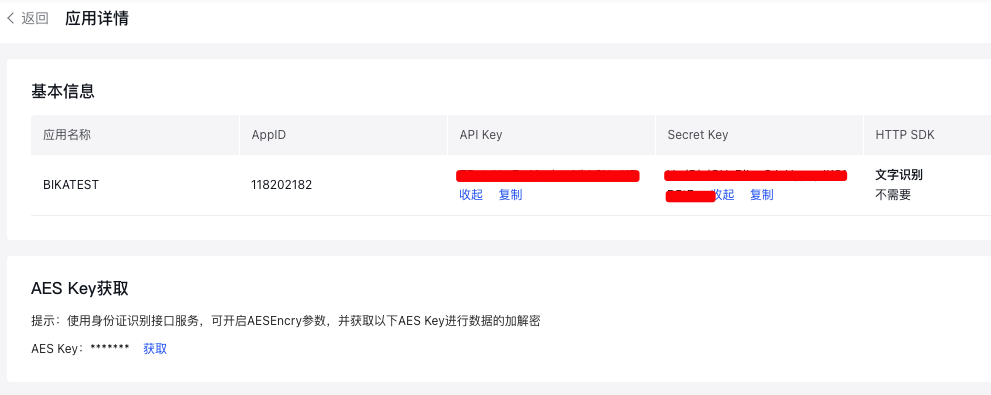

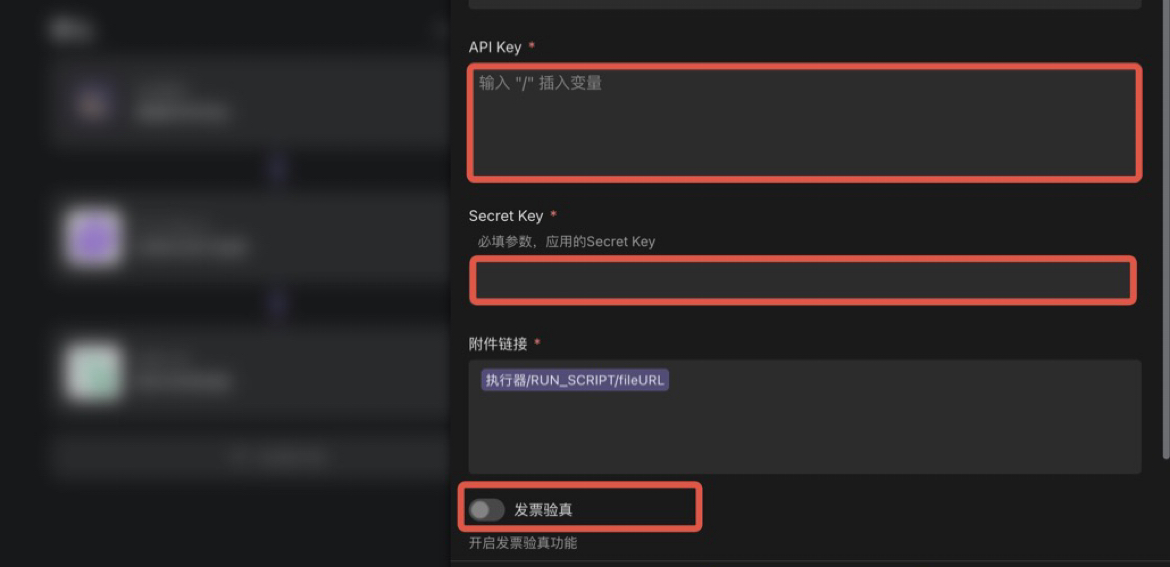

Enter Bika automation Automatic Invoice Recognition and Processing, fill in your

API KeyandSecret Keyin the Invoice Recognition and Verification ToolSDK, and save the configuration.

If you need to verify invoices, you need to enable the invoice verification button in the Invoice Recognition and Verification ToolSDK.

-

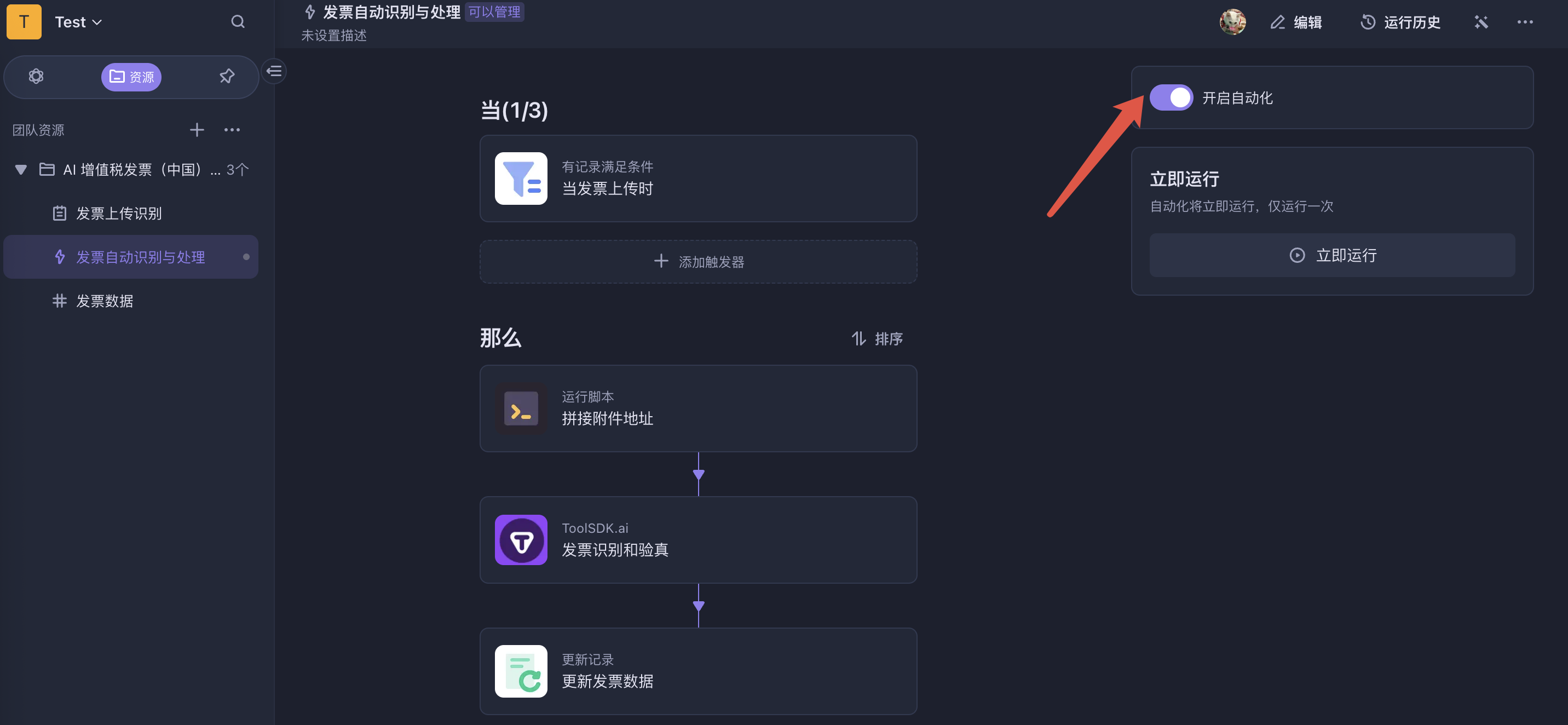

Enable the AI Invoice Recognition Database automation.

-

-

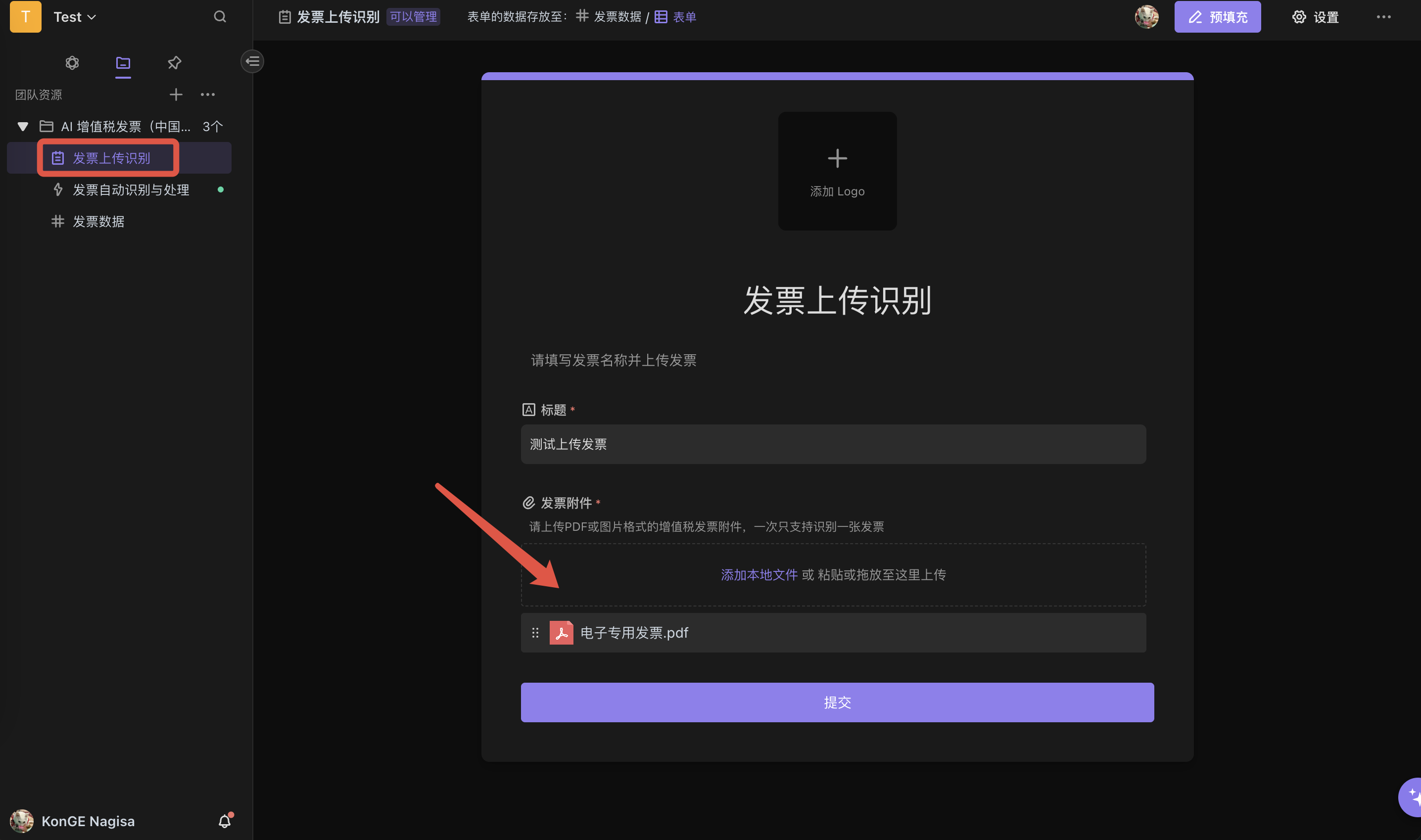

Upload Invoices for Recognition:

Go to the Invoice Upload Recognition form to upload invoice images and submit. After a few seconds, you can see the data recognized by AI in the Invoice Data table.

⭐ Use Cases

- Automated Invoice Processing: Improve financial work efficiency through automated recognition and recording of invoices.

- Invoice Verification: One-click verification of uploaded invoices after recognition, eliminating manual checks.

- Financial Data Management: Reduce manual errors and improve the accuracy of financial data.

- Expense Tracking: Easily extract and organize expense information from invoices.

👥 Target Users

- Finance Teams: Automatically extract invoice data, reducing manual workload.

- Small and Medium Enterprises (SMEs): Optimize invoice management and financial tracking.

- Accounting Professionals: Enhance efficiency in managing invoices in bulk.

- Procurement Departments: Simplify the processing of purchase orders and supplier invoices.

🔧 FAQ

-

What types of invoices can be recognized?

This template supports the recognition of Chinese VAT invoices, including general VAT invoices, special VAT invoices, and fully electronic invoices (new nationwide unified electronic invoices, special/general invoices). It includes basic invoice information, seller and buyer information, product information, price and tax information, etc., with an accuracy rate of over 99.9% for the five essential fields; it also supports the recognition of 21 key fields for VAT roll invoices, including invoice type, invoice code, invoice number, machine-printed number, machine number, payee, seller name, seller taxpayer identification number, invoice date, buyer name, buyer taxpayer identification number, project, unit price, quantity, amount, tax amount, total amount (in lowercase), total amount (in uppercase), verification code, province, and city, with an accuracy rate of up to 95% for the four essential fields.

-

What image formats are supported? Can PDFs be recognized?

Currently, this template supports the following image formats: PNG (.png), JPEG (.jpeg / .jpg), and also supports direct recognition of PDF (.pdf) files. To ensure recognition quality, it is recommended to upload clear files without excessive compression. Note: Only one invoice can be verified at a time!

-

Is there a limit on the number of invoice recognitions or verifications? How can I see my available resource amount?

If you are an individual user, the free available recognition times for VAT invoices are 1000 times/month, and the free available verification times are 20 times. If you are a business user, the free available recognition times for VAT invoices are 2000 times/month, and the free available verification times are 50 times. The free resource times for the verification function do not reset every month.

You can check your resource usage in the console and purchase resources as needed.

-

How to automatically extract invoice information and update it to the table?

You can refer to the VAT Invoice Recognition Parameter Description and VAT Invoice Verification Parameter Description to view the returned result parameters, and configure the required information in the table to fit your needs. If you need to obtain other information from the invoice and automatically update it to the table, you can refer to the following example for operation.

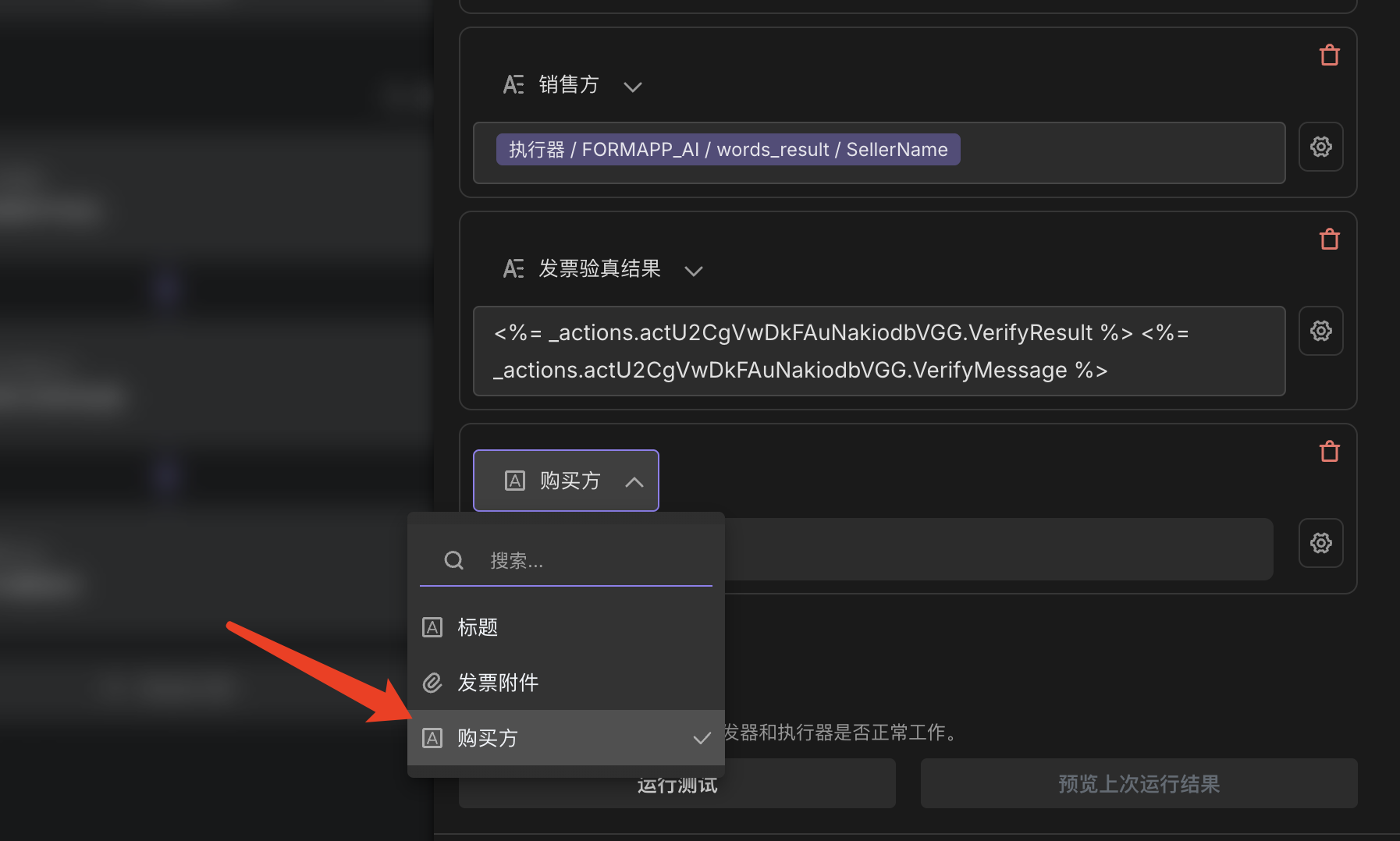

🔖 Modification Example: Add "Purchaser" Field Recognition

Suppose we need to recognize the Purchaser information from the invoice and record it in the data table, we can follow these steps:

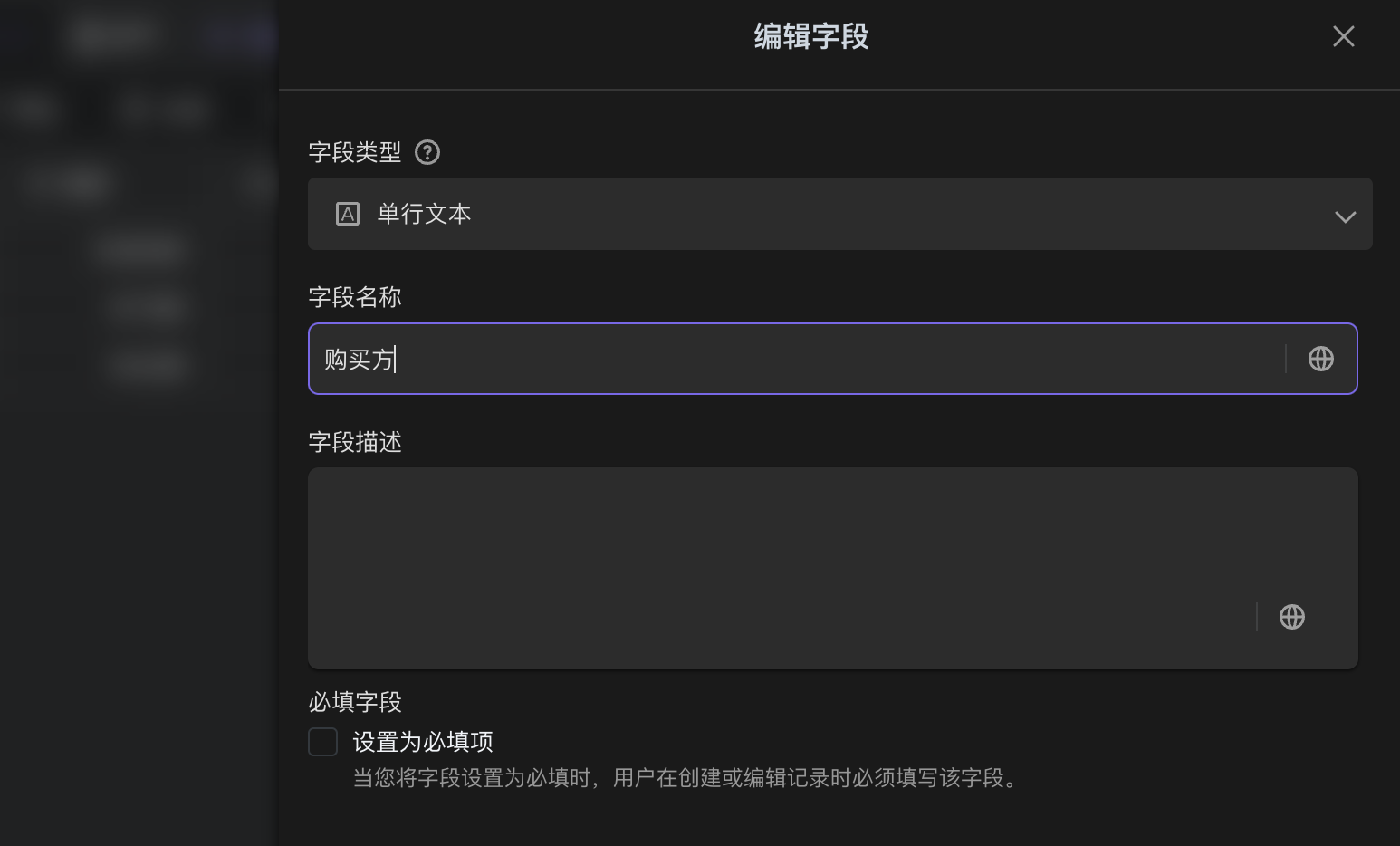

- Add Field

-

Go to the Invoice Data table and add a new

Purchaserfield to store the purchaser's information.

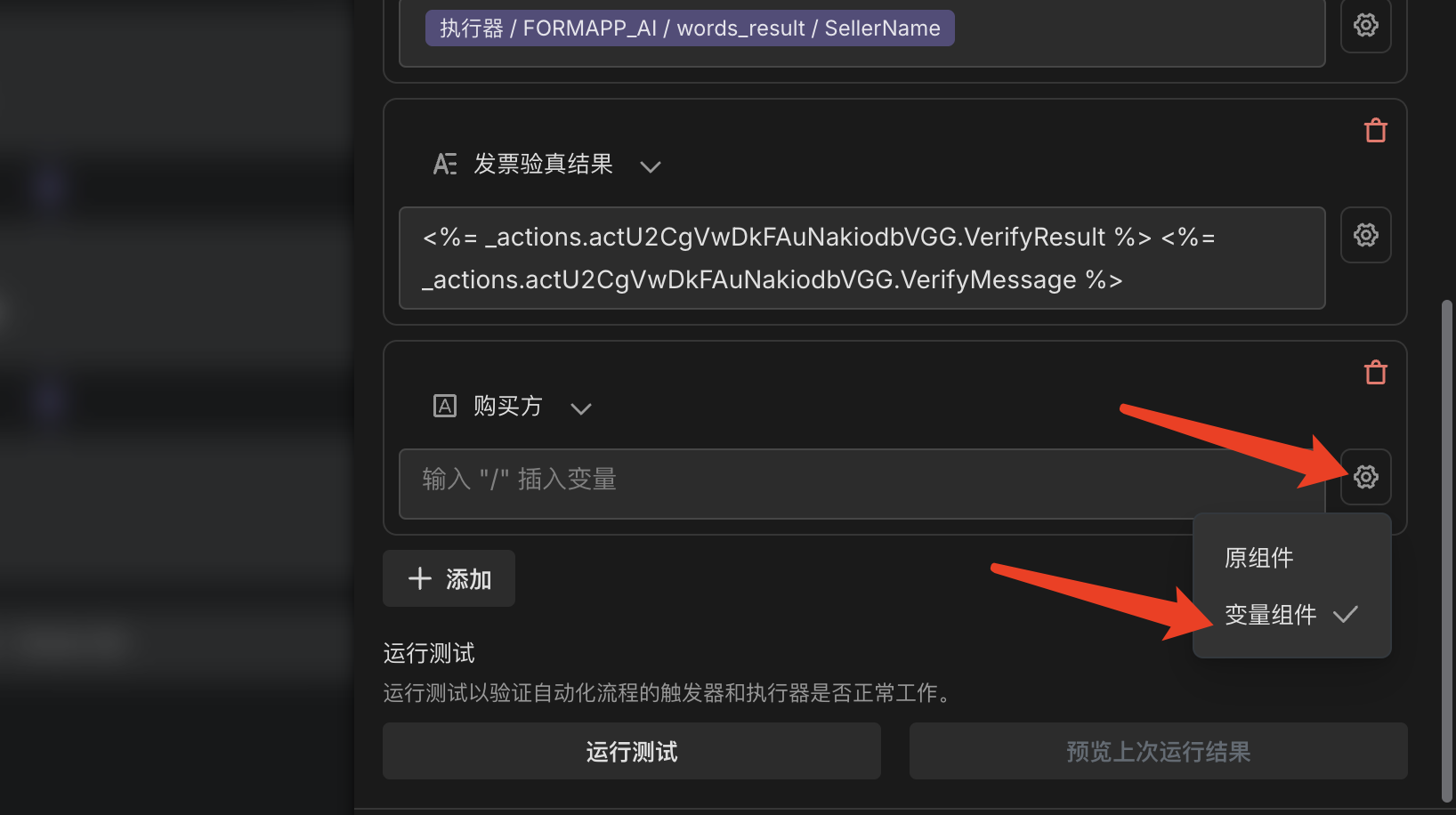

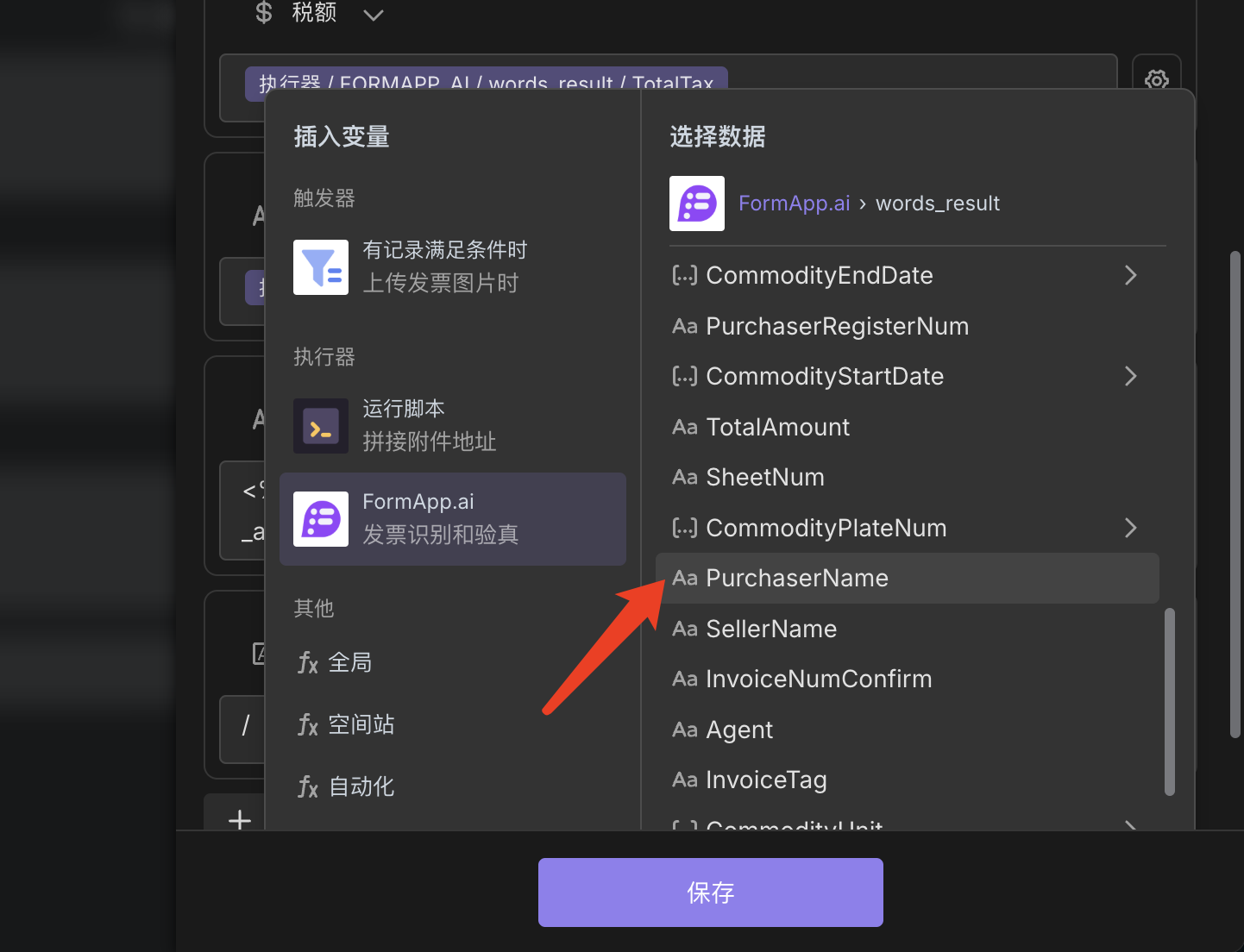

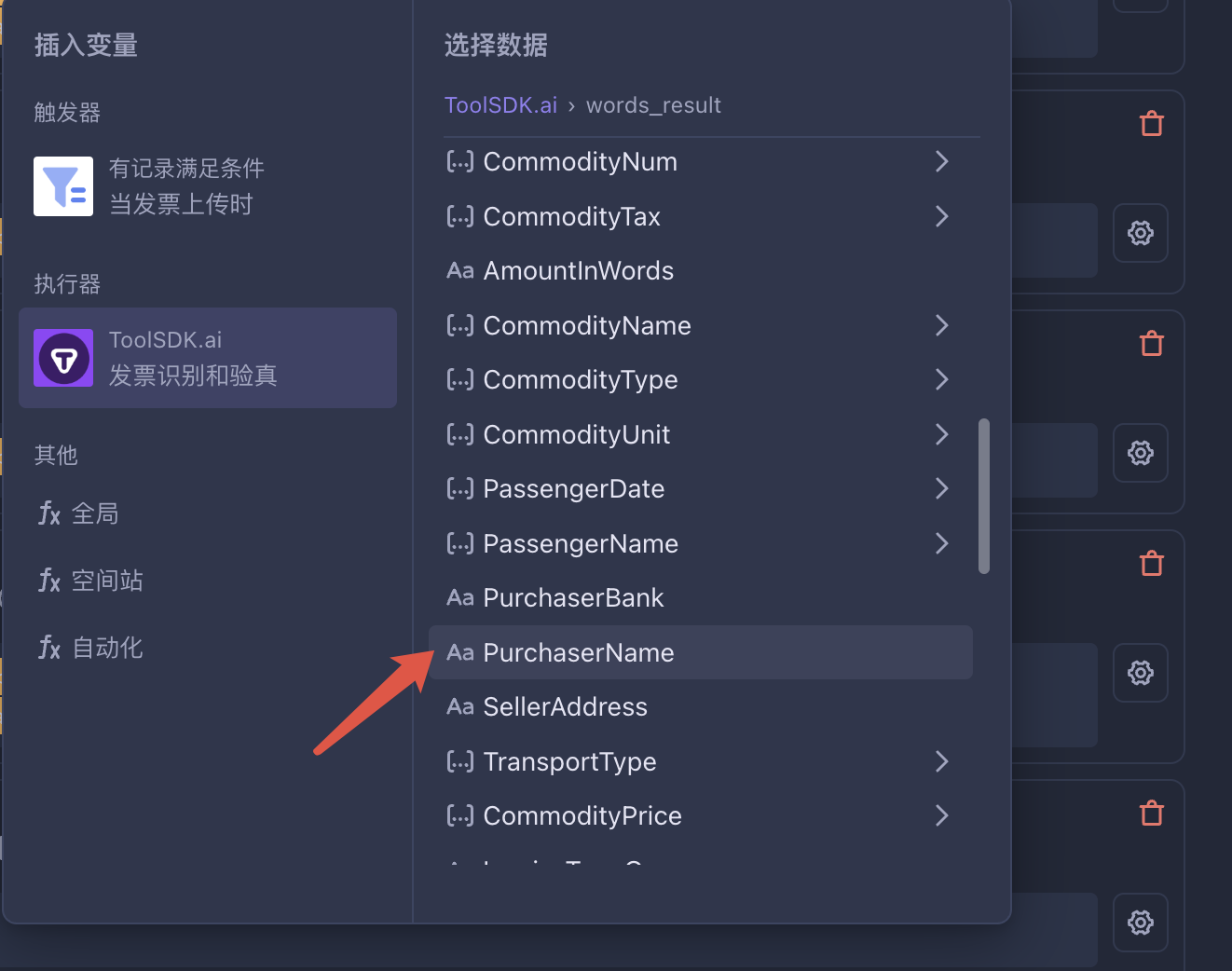

- Configure Automation

-

Open the Automatic Invoice Recognition and Processing automation process and go to the configuration page for Update Record.

-

Add mapping configuration for the

Purchaserfield and switch to Variable Component.

-

Enter

/to bring up the variable selector, select thePurchaserNameparameter from the Invoice Recognition and Verification ToolSDK, and save the configuration.

- Upload the invoice to trigger automation and verify the recognition results.

🎉 Congratulations! Your invoice recognition template now supports the extraction of "Purchaser" information!